income tax rates nz

Income Tax Rates PAYE. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021.

October 2017 Let S Talk About Tax Nz

The Convention is based to a large extent.

. 50320 plus 3900 of the amount over 180000. The new rate will apply from 1 April next year the 2021-22 income year. This income tax calculator can help estimate your average income tax rate and your salary after tax.

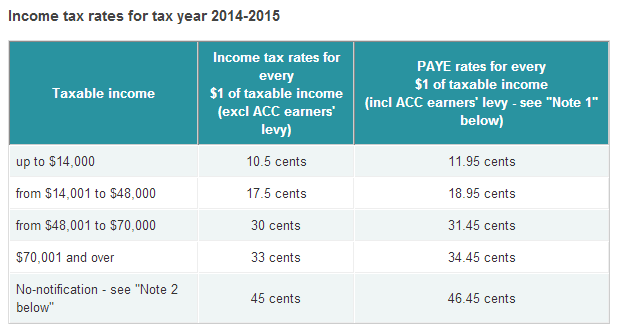

New Zealand has a simple progressive and fair tax system - people with higher taxable incomes pay higher PAYE tax rates. It also will not include any tax youve already paid through your salary or wages or any ACC earners levy. Income up to 14000.

The income tax system in New Zealand has 5 different tax brackets. To use this income tax calculator simply fill in the relevant data within the green box and push Calculate. This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary.

New Zealand Personal Income Tax Rate Personal Income Tax Rate in New Zealand for individuals earning more than NZD180000 a year increased to 39 percent in 2021 from 33 percent in 2020. 1470 plus 1750 of the amount over 14000. With the correct tax code you can either.

2021 and 2022. Tax codes and rates income and expenses paying tax and getting refunds. All Income tax dates.

Individuals pay progressive tax rates. 39 personal tax rate legislation introduced 3 December 2020 6 min read The Government yesterday introduced under Parliamentary urgency legislation for the new 39 personal tax rate on income above 180000. For income earners earning 38000 or more the marginal tax rate on the first 38000 of income was 195 percent.

The company tax rate is 28. Debt help - debt is everywhere in New Zealand and our guide walks you through the options available. Recording income and expenses filing returns paying tax for all businesses and organisations earning money in New Zealand.

Includes the low-income-earner-rebate. 7 rows New Zealand dollars. Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources.

1050 of taxable income. Tell your employer or payer what your code is otherwise they will tax you at the higher non-declaration rate of 45. Work out my tax code.

New Zealand went through a major program of tax reform in the 1980s. You need to tell your employer or payer if your tax code changes. Everyone in New Zealand needs to pay tax on income they earn whether theyre an individual business or organisation.

2020 and 2021. Current Income Tax Rates. Income Tax Rates and Thresholds Annual Tax Rate.

There is no social security payroll tax. You should still however file after the end of the year for any tax refunds from the IRD. Tax codes are different from tax rates.

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Apply for NZ Super. 7420 plus 3000 of the amount over 48000.

14020 plus 3300 of the amount over 70000. America and New Zealand for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income together with a related Protocol signed at Wellington on July 23 1982. We often get asked what the actual tax rates are for individuals and business.

The personal income tax rate in New Zealand is progressive and ranges from 105 to 39 depending on your income. You need to work out your tax code for each source of income you receive. New Zealand tax rates have varied over the.

Tax on investments or savings. Compare personal bank loan rates in NZ Personal loans referred to as guaranteed or unsecured loans was funds borrowed from a financial credit score rating union or an online loan provider that you pay off over a collection. Personal income tax scale.

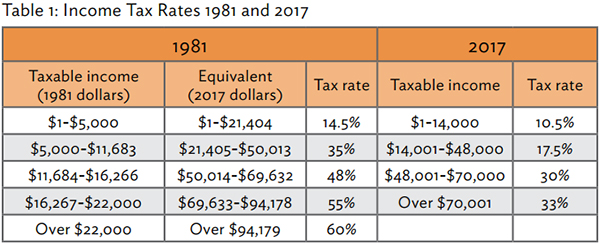

For Reference - Income Tax Rates PAYE. If you are looking to find out your take-home pay from your salary we recommend using our. The top marginal rate of income tax was reduced from 66 to 33 changed to 39 in April 2000 38 in April 2009 and 33 on 1 October 2010 and corporate income tax rate from 48 to 28 changed to 30 in 2008 and to 28 on 1 October 2010.

Taxable income bracket Tax owed. In Budget 2008 Hon Dr Michael Cullen announced a series of income tax cuts which were to occur over three phases with the first phase to commence from 1 October 2008. New Zealand Income Tax Rates Over Time.

Change your tax code for NZ Super if youre already getting NZ Super but using the wrong tax code. Income over 14000 and up to 48000 1750. New Zealand Residents Income Tax Tables in 2020.

From 1 April 2021 any income over 180000 is taxed at a marginal rate of. Goods and services tax GST rate. The GST rate is 15.

Work out tax on your yearly income. How many income tax brackets are there in New Zealand. They help your employer or payer work out how much tax to deduct before they pay you.

Do I get a tax refund at the end of the year. However being in a tax bracket doesnt mean you pay that PAYE income tax rate on everything you earn. You also need to make sure that any money you get from investments or interest is taxed at the correct rate.

5 rows The amount of tax you pay depends on your total income for the tax year. Company Tax Rate 28. Work and Income handles NZ Super.

Tax codes only apply to individuals. The way New Zealands tax system works means that anyone with higher. Youre not required to pay income tax if you didnt earn money for a certain period and only those who reach the 14000 threshold are subject to being taxed at 105.

105c per 1 on annual taxable income up to 14000 175c per 1 on annual taxable income between 14001 and 48000 30c per 1 on annual taxable income between 48001 and 70000 33c per 1 on annual taxable income over 70000. Trust Tax Rate 33. New Zealand Inland Revenue Department 10Y 25Y 50Y MAX Chart Compare Export API Embed New Zealand Personal Income Tax Rate.

Personal Income Tax Reform In New Zealand Scoop News

The History Of Tax Policy In New Zealand Interest Co Nz

62 400 After Tax Nz Breakdown February 2022 Incomeaftertax Com

Income Tax In New Zealand Moving To New Zealand

Tax Accountant Tax Rates Income Tax Tax Facts Nobilo Co

Taxation In New Zealand Wikiwand

New Zealand Tax Schedule For Personal Income Tax Download Table

Experienz Immigration Nz Immigration Advisors Experienz Immigration Services Ltd

New Zealand S Experience With Territorial Taxation Tax Foundation